Table of Contents

In the currency market, understanding carry trade strategy is extremely important for the investors. Perfect fundamental and technical analysis will help investors to squeeze out decent annual returns from the forex market. Today you will learn the fundamentals of carry trade strategy with carry trade example.

Understanding Carry Trade in Forex Market

Like investment in any market, we also invest in forex with a hope that the price of the currency pair that we have just bought will increase in the future and we can then sell that pair and eke out profit as everyone does. But there are ways by which you do not have to wait for the price of the invested currency pair to increase. You can still make a profit even if the price remains the same for a longer period of time. This method of making money is called “carry trade” or “carry trade strategy”.

Under this method, we have to buy a financial instrument like a currency pair with a lower interest rate, then you can use it to purchase a financial instrument with a much higher interest rate. In this way, we will be paying a low-interest rate on the asset that we have sold and collecting a higher rate than we have purchased. Here we will be making a profit through the “interest rate differentials”.

Examples

Suppose, you went into a commercial bank and borrowed $10,000. But their interest rate is 1% of the borrowed sums for every year. With that money, you purchased a bond worth $10,000 which yields 5% a year. So what is your profit? And the answer is 4% (5 – 1)%. That’s the difference between interest rates. Since we take credit in conducting trade in the forex so in this situation a 3% interest rate differential becomes 60% annual interest rate a year if the account is leveraged 20 times.

Leveraged

Suppose, you went into a commercial bank and borrowed $1000,000. But their interest rate is 1% of the borrowed sums for every year. Here the collateral that you have placed is worth $10,000. After borrowing the sum, you came out of the bank, went to another commercial bank that pays 5% interest rate annually and you placed that borrowed $1000,000 in a savings account. Here the interest rate from the bond will be ($1,000,000 X .05) = $50,000. The interest that you paid will be ($1,000,000 X .01) = $10,000. Your net profit will be $40,000, a 400% return.

Currency

Suppose, you found a currency pair whose interest rate differential is +5% a year and you purchased $100,000 worth of that pair. Assume that your broker requires 1% deposit for the invested position, meaning they will hold $1,000 in the margin (100:1 leverage). Here in this situation, there are three distinct possibilities that may take place and those are discussed below:

- Loss of Currency Position Value: If the pair that you have bought has lost its value like a free fall. If the loss is such that it has brought the account down to the amount put aside for the margin then the position is closed and all that is left is the margin of $1,000.

- The Currency Pair Ends Up at the Same Rate: Here in this situation you will neither lose nor gain anything but you will be able to collect an approximate 5% interest rate in the $100,000 position. That means using interest rate only you will be making $5,000, a 50% gain.

- The gain in Currency Position Value: If the pair that you have a position in gains in value then you will not only achieve $5,000 in interest rate but you can also take home monetary gains.

As a result of 100:1 leverage, you have the opportunity to earn around 50% in a year using the initial investment of $10,000.

Time When Carry Trade Works Best

As with any other investment decision, carry trade also has economic dynamics behind it. As a trader, you will be buying only those currencies whose economy is supposed to go up. When the economy is supposed to experience growth then there will soon be inflationary pressure in the economy. As a result, the central bank of that country will step in and may decide to raise the interest rate to tame inflation. If that happens then investing in that currency will become very lucrative. In this situation, you will be able to achieve hefty profit if you collect money from where the interest rate is low and invest in a currency whose interest rate is high. To carry out trade successfully, you need to have a good economic outlook for the desired currency of investment.

Criteria of Carrying a Trade

A carry trade strategy has two main criteria and those are discussed below:

- Finding a high-interest rate differential;

- Finding a currency pair that has been stable for quite some time or in an upward trajectory. This gives one to stick to the trade as long as possible.

A Practical Example of Carry Trade Strategy

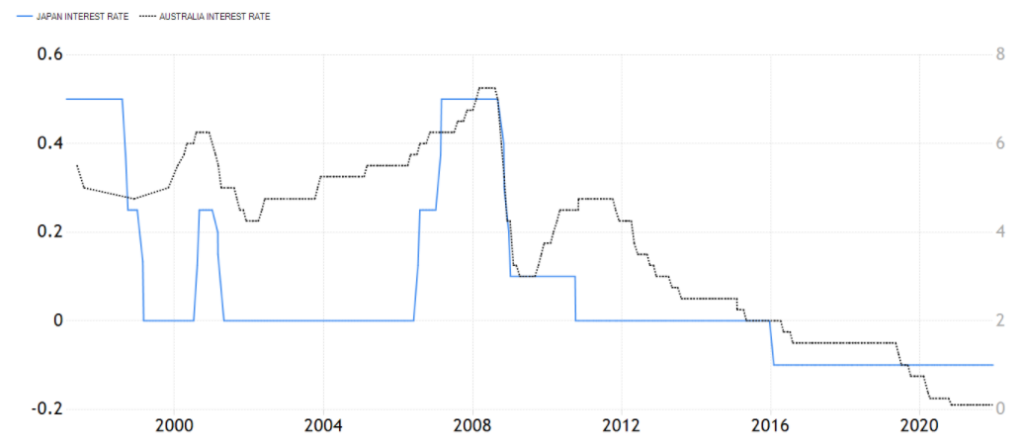

From the beginning of 2002- 2008, the pair of AUD/JPY has moved from 65.0 to 105.0. A whopping of approximately 4,000 pips. The Reserve Bank of Australia (RBA) has set an interest rate that was one of the highest among the economies with a major currency. While the Bank of Japan (BoJ) has kept the interest rate “near-zero” or at 0.10%. Sensing this opportunity, a lot of investors and speculators alike flock to this pair and achieve huge profits in the long run.